Our regional forecast predicts slowing home price growth, lower mortgage rates, and more inventory as homeowners return to the market.

Home sales will rebound in 2024. In 2023, the overall number of home sales transactions across the Bright MLS footprint was down 22% compared to 2022, with monthly sales activity tracking well below pre-pandemic levels. Elevated mortgage rates and rising prices have made the market more challenging for some prospective buyers, which has dampened demand. But sales activity was weaker in 2023 for other reasons. A lack of inventory continued to be a constraint on transactions. And some buyers who would have been in the market in 2023 had pushed their home purchase up earlier to take advantage of the historically low mortgage rates of the pandemic era.

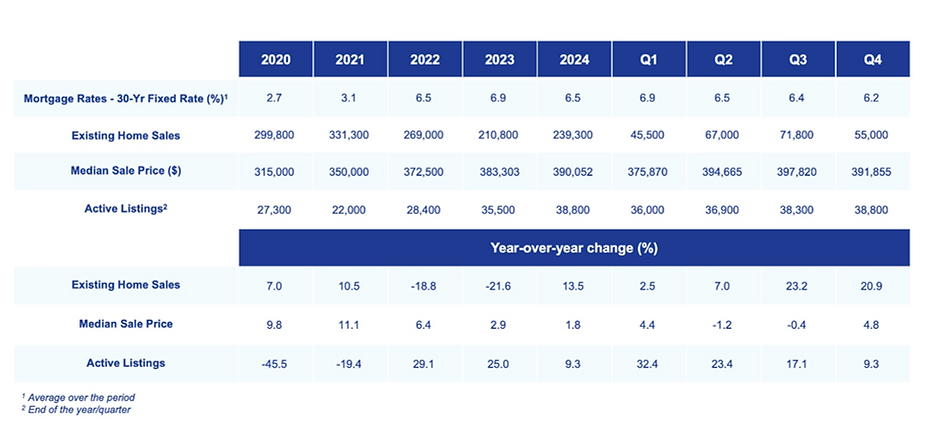

There is still strong demand for homeownership across Bright’s markets. As mortgage rates ease and inventory loosens in 2024, the overall number of home sales will increase. The forecast is for 239,300 total home sales across the Bright MLS service area in 2024, an increase of 28,500 sales over 2023, or a 13.5% gain. Sales activity is expected to rebound somewhat more strongly in the Bright MLS service area than in the U.S. overall, with the biggest increase in sales activity in the region’s smaller and more affordable markets.

Inventory will increase but will remain below pre-pandemic levels.

The available supply of homes for sale hit record lows during the pandemic, and that lack of inventory has been a major constraint on home sales activity across the Bright MLS service area. The number of active listings had started to increase in many markets in 2023, driven primarily by a slowdown in new contracts, as opposed to an increase in new listing activity. At the end of 2023, it is expected that there will be a total of 35,500 active listings across the Bright MLS service area, up 25% from a year ago but still significantly lower than what it was in 2019.

One challenge to new listing activity has been the so-called “lock-in” effect, where existing homeowners who might have listed their home are staying put because they have a very low mortgage rate. With rates that approached 8% at the end of 2023, there is little incentive for current mortgage holders to trade out their low rate.

However, even homeowners with super low mortgage rates will increasingly find that changing family and financial circumstances will compel them to move, and list their home for sale. Expect more new listing activity throughout 2024 as mortgage rates head toward the mid-6s.

Inventory will still be low by historic standards. Across the Bright MLS service area, there is forecasted to be 38,800 active listings at the end of 2024, a 9.3% gain from year-end 2023. However, inventory at the end of 2024 will still be just three-quarters (77%) of the listings available in 2019. Inventory will remain most constrained in the region’s more affordable markets.

Prices will continue to rise in 2024. Despite higher interest rates, home prices in most markets across the Bright MLS service area continued to rise in 2023, reaching new highs during the summer. Home prices eased seasonally at the end of the year. Overall, the 2023 median sale price in the Bright MLS service area is forecasted to be $383,300, which is up 2.9% compared to 2022. While this rate of home price appreciation is much slower than during the pandemic, it is more in line with typical price growth in the region.

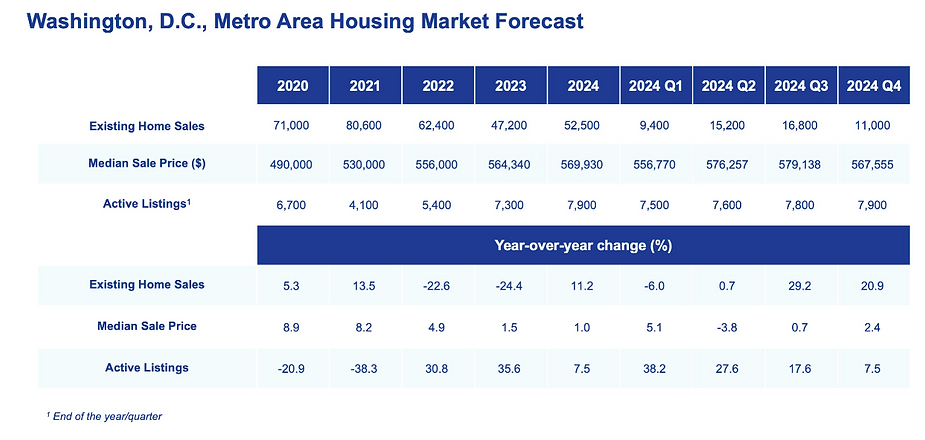

As inventory increases in 2024, price growth will moderate further; however, there are no signs to suggest that prices will fall in Bright MLS markets. Overall, the median price is forecasted to rise by 1.8% between 2023 and 2024, with the slowest pace of home price appreciation in the Washington, D.C., metro area (+1.0%) and the fastest price growth in the Central Pennsylvania market (+3.9%).